Get Difficult Tax Problems Answered Online Quickly

Are you a CA, CPA or IPA member and need an experienced tax practitioner to help you with those obscure or difficult questions?

It might be a new area for your practice, a controversial one, or one where a client is proposing a high risk position. It might be one that is unsettled or might draw ATO attention.

Fast and professional – we acknowledge your query immediately and our qualified and experienced tax accountants (the Taxticians) can usually respond within 5 working days depending on complexity.

Ask the professionals – ask the Taxticians.

Liability limited by a scheme approved under Professional Standards Legislation

We offer two question options:

Expert Response

A single standard question is clear, focused, and about one specific topic. Our answer provides your client with ‘comfort’ as they have obtained independent expert advice. It can be answered fully in one reply without needing detailed documents or follow-up discussion.

We will respond via email.

Cost per Expert Response $600.

Please allow 5 working days for our response.

Detailed Opinion

A comprehensive question is more complex and may cover multiple topics or require detailed explanation. It often needs supporting documents and a longer response. Obtaining a detailed opinion provides you or your client with extra ‘comfort’ as they have consulted and received Independent expert advice.

We will respond via email.

Cost per Detailed Opinion $1500.

Please allow up to 15 working days for our response. If we need more time or information, we will advise.

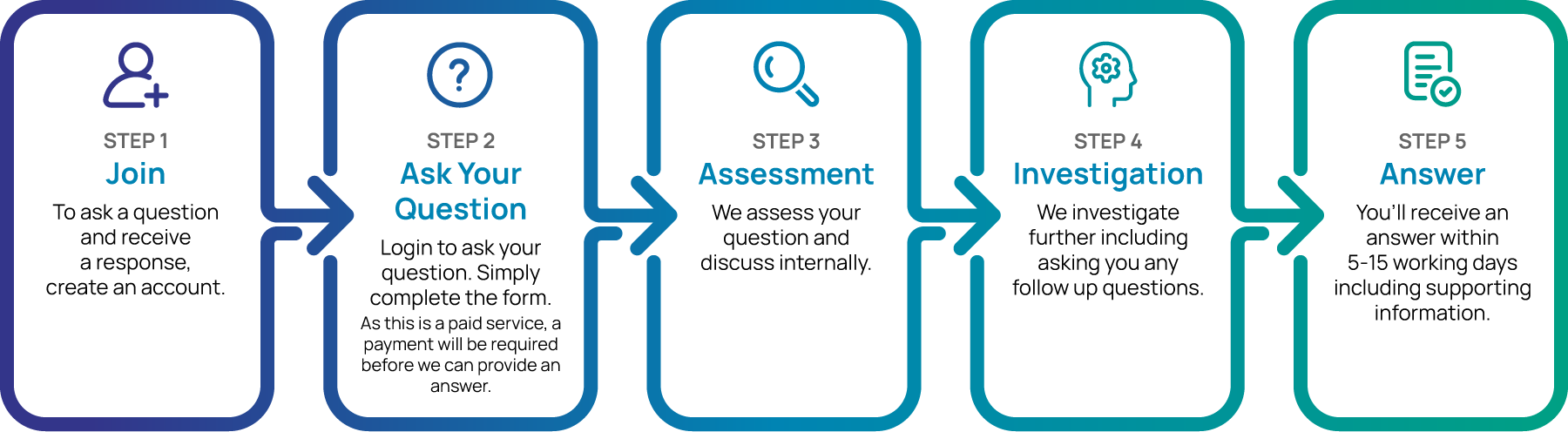

To ask a question and receive a response, please create an account.

As this is a paid service, a payment will be required before we can provide an answer.

Real Client Scenario

SCENARIO 1

Expert Response

We advised a client on the likely tax implications of various business structures and investment options for property owned by Ms. S.H. Our guidance focused on the most commonly used structures in this context, highlighting their respective tax positions to support informed decision-making.

SCENARIO 2

Expert Response

SCENARIO 3

Detailed Opinion

How it works

Meet our Taxticians

Miles Deayton

Miles Deayton

While spending thirty years at the Australian Taxation Office (ATO) focused on large business compliance, managing audit teams and having a hand in developing these systems for compliance, Miles gained in-depth experience and knowledge of the ATO and the intricacies of how it operates. Since leaving the ATO, Miles has consulted as an interface between private practice accounting and the ATO working across all tax types including; income tax, compliance activities and audits, procedural requirements such as debt management and ruling requests.

Miles is acknowledged as a leader in providing tax related guidance and independent advice on how to navigate the ATO and prepare your customers when facing them across a broad range of matters. Miles is approachable, can appreciate many perspectives and is committed to achieving fair and reasonable outcomes for his clients. In his spare time Miles does what he is told.

Ross Wadelton

Ross Wadelton

Ross also held senior roles in the International Centre of Expertise (COE), Tax Counsel within TCN, and, for 2 years, as senior director providing leadership and direction to 8 audit teams in the PGH line dealing with the many issues arising with large and complex private groups. Within PGH, Ross also held senior roles in Case Leadership and Technical issues with a specific focus on resolution of the most difficult audit and tax technical issues within that market. Away from work, Ross enjoys playing lawn bowls, bike riding with friends, caravan holidays with his family, and supporting the Collingwood Football Club.

Peter Maher

Peter Maher

Following on from his illustrious career with the ATO, Peter was appointed as a Tax Principal at Deloitte where he provided tax consulting advice to a range of clients, including tax planning, governance and managing disputes with the ATO. After spending four years with Deloitte, Peter returned to work at the ATO. During this later period with the ATO he was engaged as a tax consultant with the International Monetary Fund and the World Bank where he travelled extensively to Kenya, Botswana, Vietnam and China working closely with Tax Administrations in those countries.

Peter worked for a time as a tax consultant with the Australian Energy Regulator and currently works with Tax Inspectors Without Borders, a joint United Nations (UN) and The Organisation for Economic Co-operation and Development (OECD) initiative to assist tax administrators in developing countries to conduct tax audits.

In his spare time Peter enjoys swimming, playing golf (badly), travel with his family, and following the Hawthorn Football Club.

Kevin O’Shaughnessy

Kevin O’Shaughnessy

Given Kevin’s experience in the entire tax cycle, he is able to see a tax issue from all sides and resolve your issue.

Testimonials

Contact Us

Contact us to discuss your tax question.

Better still, register and ask your question online.

Call us on 1300 661 387 or complete and send the form below: